Footwear and accessories discount retailer Designer Brands (NYSE:DBI) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 3.2% year on year to $752.4 million. Its non-GAAP profit of $0.38 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Designer Brands? Find out by accessing our full research report, it’s free for active Edge members.

Designer Brands (DBI) Q3 CY2025 Highlights:

- Revenue: $752.4 million vs analyst estimates of $763.4 million (3.2% year-on-year decline, 1.4% miss)

- Adjusted EPS: $0.38 vs analyst estimates of $0.18 (significant beat)

- Operating Margin: 5.7%, up from 2.9% in the same quarter last year

- Locations: 672 at quarter end, down from 675 in the same quarter last year

- Same-Store Sales fell 2.4% year on year, in line with the same quarter last year

- Market Capitalization: $240.3 million

"Our third quarter performance represents another meaningful step forward in our transformation, as we demonstrated continued sequential improvement across multiple financial and operating metrics," stated Doug Howe, Chief Executive Officer.

Company Overview

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

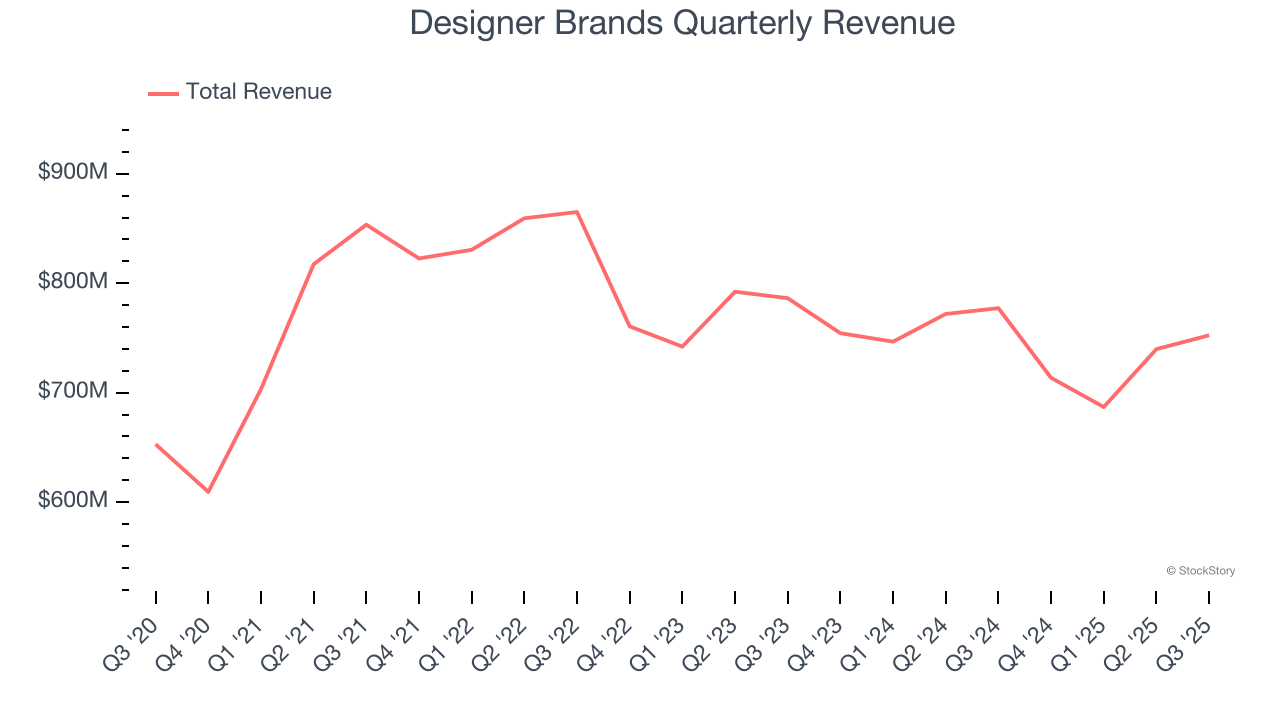

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.89 billion in revenue over the past 12 months, Designer Brands is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Designer Brands’s demand was weak over the last three years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 5% annually despite opening new stores. This implies its underperformance was driven by lower sales at existing, established locations.

This quarter, Designer Brands missed Wall Street’s estimates and reported a rather uninspiring 3.2% year-on-year revenue decline, generating $752.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months. While this projection indicates its newer products will fuel better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

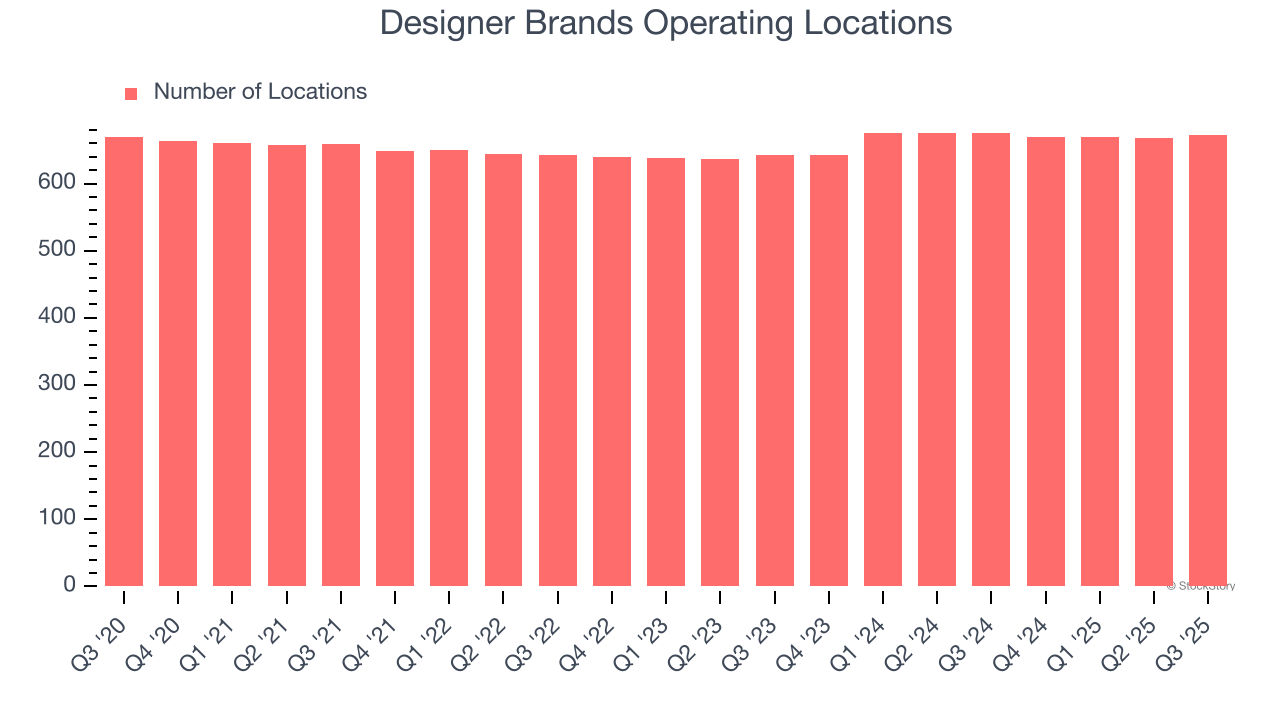

Number of Stores

Designer Brands sported 672 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 2.4% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

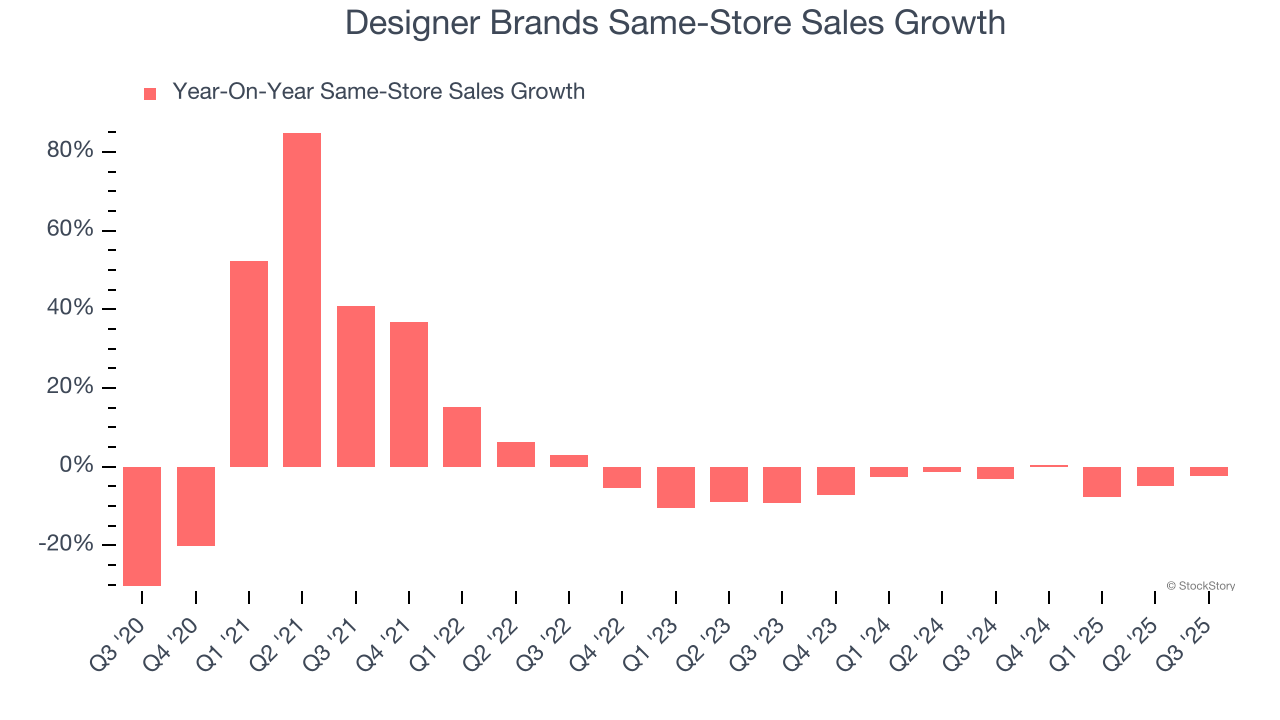

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Designer Brands’s demand has been shrinking over the last two years as its same-store sales have averaged 3.6% annual declines. This performance is concerning - it shows Designer Brands artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Designer Brands’s same-store sales fell by 2.4% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Designer Brands’s Q3 Results

It was good to see Designer Brands beat analysts’ EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 13.7% to $5.51 immediately after reporting.

Indeed, Designer Brands had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.