JPMorgan Chase & Co (JPM)

289.92

+0.44 (0.15%)

NYSE · Last Trade: Mar 9th, 5:12 PM EDT

Detailed Quote

| Previous Close | 289.48 |

|---|---|

| Open | 285.50 |

| Bid | 289.76 |

| Ask | 290.00 |

| Day's Range | 280.45 - 291.10 |

| 52 Week Range | 202.16 - 337.25 |

| Volume | 12,219,977 |

| Market Cap | 893.65B |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 6.000 (2.07%) |

| 1 Month Average Volume | 10,716,084 |

Chart

About JPMorgan Chase & Co (JPM)

JPMorgan Chase & Co. is a leading global financial services firm that provides a wide range of financial solutions to consumers, businesses, and governments. The company offers investment banking, asset management, private banking, and wealth management services while also delivering a full suite of commercial banking products. With a strong emphasis on innovation and technology, JPMorgan Chase plays a pivotal role in the financial market, helping clients navigate complex financial landscapes through expert advice and tailored services. The firm is committed to maintaining its reputation for integrity and professionalism while actively contributing to economic development and community investment. Read More

News & Press Releases

NEW YORK — As of March 9, 2026, the American financial landscape is undergoing its most radical transformation in nearly two decades. The "One Big Beautiful Bill Act" (OBBBA), signed into law just eight months ago, has effectively dismantled the regulatory scaffolding of the Dodd-Frank era, ushering in what analysts are

Via MarketMinute · March 9, 2026

As of March 9, 2026, the American financial landscape is undergoing its most significant structural shift in decades. The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which was signed into law in mid-2025, has moved from a legislative blueprint to an operational reality. Today's discussions in

Via MarketMinute · March 9, 2026

On March 9, 2026, RBC Capital Markets issued a significant upgrade for Dow Inc. (NYSE: DOW), elevating the chemical giant from "Sector Perform" to "Outperform" and raising its price target from $29.00 to $40.00. This bullish pivot comes as a direct response to escalating geopolitical instability in the

Via MarketMinute · March 9, 2026

In a landmark decision that signals a definitive end to the post-2023 era of regulatory tightening, Federal Reserve Vice Chair for Supervision Michelle Bowman unveiled a "capital-neutral" re-proposal of the Basel III Endgame today, March 9, 2026. Speaking at the American Bankers Association (ABA) Washington Summit, Bowman detailed a framework

Via MarketMinute · March 9, 2026

Goldman Sachs (NYSE: GS) delivered a resounding message to the financial world this morning, reporting a massive fourth-quarter earnings beat that has analysts recalibrating their outlooks for the entire investment banking sector. As analyzed on March 9, 2026, the firm reported earnings per share (EPS) of $14.01, obliterating the

Via MarketMinute · March 9, 2026

WASHINGTON D.C. — In a move that signals the most significant shift in American monetary policy in over four decades, the White House has officially nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. Dubbed the "Warsh Pivot" by Wall Street analysts, the nomination on

Via MarketMinute · March 9, 2026

Ethereum based crypto Pepeto just announced that the latest presale stage sold out in under 48 hours, and the team

Via First Publisher · March 9, 2026

As of March 9, 2026, the long-predicted "reckoning" for American small-cap stocks has officially arrived. While the broader market remains buoyed by the resilient "Magnificent Seven" and a robust AI infrastructure supercycle, the Russell 2000 (IWM) has hit a formidable roadblock: a $1.35 trillion "debt maturity wall." After a

Via MarketMinute · March 9, 2026

NEW YORK — As of March 9, 2026, the American corporate landscape has officially entered what analysts are calling the "Efficiency Era." The S&P 500 has achieved a historic milestone, with blended net profit margins reaching a landmark 13.1%—a figure that has surpassed the previous all-time high of

Via MarketMinute · March 9, 2026

The kickoff of the 2026 Big Bank earnings season in mid-January provided a critical litmus test for the health of the U.S. financial system, revealing a sector that remains remarkably resilient despite lingering macroeconomic uncertainties. As JPMorgan Chase (NYSE: JPM) and Bank of America (NYSE: BAC) set the stage

Via MarketMinute · March 9, 2026

As of March 9, 2026, the United States economy finds itself at a historic crossroads, propelled by a surge in artificial intelligence investment that has defied early skeptics. New data from the Federal Reserve and major Wall Street institutions suggest that AI-related capital expenditure and infrastructure development have become the

Via MarketMinute · March 9, 2026

The U.S. Mergers and Acquisitions (M&A) landscape has entered a blistering new phase of activity, shaking off the volatility of the mid-2020s to reach levels of engagement not seen in over half a decade. Driven by a historic flood of "dry powder" and a rapidly stabilizing macroeconomic environment,

Via MarketMinute · March 9, 2026

The global financial landscape underwent a seismic shift this week as the formal nomination of Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve reached the Senate floor. The move, finalized on March 4, 2026, marks the beginning of the end for the "Powell Era" of gradualism

Via MarketMinute · March 9, 2026

NEW YORK — The American economic engine, which appeared resilient throughout much of 2025, is grinding toward a near-halt in the opening months of 2026. Market analysts and federal agencies are sounding the alarm as the U.S. Gross Domestic Product (GDP) is projected to expand by a meager 0.2%

Via MarketMinute · March 9, 2026

As the first quarter of 2026 draws to a close, Wall Street finds itself locked in a high-stakes waiting game. The upcoming April U.S. Jobs Report, which will detail labor market performance for the month of March, has become the primary focal point for investors, policymakers, and economists alike.

Via MarketMinute · March 9, 2026

Iran warned of surging prices as oil rose past $100 for the first time since June 2022, after an escalation over the weekend saw both sides reportedly target critical energy infrastructure.

Via Stocktwits · March 9, 2026

The Iran war might not lead to a big spike in inflation -- but here's what to do just in case.

Via The Motley Fool · March 9, 2026

NEW YORK — The global financial landscape shifted violently today, March 9, 2026, as the yield on the benchmark 10-year U.S. Treasury note surged toward the psychologically significant 4.50% mark. This aggressive move follows a technical breakout above the 4.20% resistance level earlier this month, a development that

Via MarketMinute · March 9, 2026

One of Wall Street's most influential CEOs is worried about high valuations.

Via The Motley Fool · March 9, 2026

As of March 9, 2026, the global aviation landscape has undergone a profound transformation, and at the center of this shift stands United Airlines Holdings, Inc. (NASDAQ: UAL). Once a legacy carrier struggling with labor relations and operational inconsistencies, United has reinvented itself over the last five years into an aggressive, premium-focused international powerhouse. Driven [...]

Via Finterra · March 9, 2026

In a day marked by extreme energy market volatility, Casey’s General Stores (Nasdaq: CASY) reported its third-quarter fiscal 2026 earnings on March 9, 2026, delivering a performance that surpassed analyst expectations despite a geopolitical shock that sent oil prices soaring. As WTI crude eclipsed the $111-per-barrel mark in weekend

Via MarketMinute · March 9, 2026

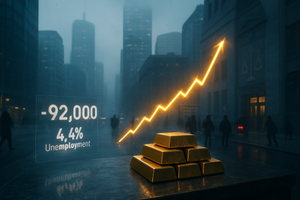

The United States labor market sent a seismic shock through global financial centers this morning as the Bureau of Labor Statistics (BLS) reported a staggering loss of 92,000 jobs for February 2026. Compounding the anxiety, the national unemployment rate climbed to 4.4%, a level not seen since the

Via MarketMinute · March 9, 2026

On March 9, 2026, global financial markets are reeling as Brent crude oil prices surged toward $120 per barrel, driven by a rapid military escalation between the United States and Iran. The benchmark West Texas Intermediate (WTI) has concurrently eclipsed $111 per barrel, trading near $118.82 as traders price

Via MarketMinute · March 9, 2026

By: MarketMinute

In a startling divergence from historical market behavior, precious metals saw a significant sell-off on March 9, 2026, even as energy markets braced for an inflationary shock. Gold futures fell 1.24% to settle at $5,107 per ounce, while silver dropped 1.32% to $83.33 per

Via MarketMinute · March 9, 2026

The United States economy was sent into a tailspin this past week following the release of a devastating February jobs report that has shattered the prevailing "soft landing" narrative. On March 6, 2026, the Bureau of Labor Statistics revealed an unexpected contraction of 92,000 jobs, a stark reversal from

Via MarketMinute · March 9, 2026